Revitalize your dental practice’s revenue stream with DRG

Dental Revenue Group ensures a stress-free revenue cycle management system for Dental practices.

Upto

About Dental Revenue Group

We are a full-fledged dental billing organization with over 1000+ professional dental billers and coders working across the United States to provide your dental practice with quality Revenue Cycle Management (RCM) services.

Whether you are a Pedodontist, Orthodontist, or Pediatric Dentist, you can avail of our dental billing services at highly affordable rates. We won’t nickel and dime you, but rather collaborate to strengthen and grow your dental practice.

Dental Revenue Group Streamlines Your Dental Billing Process

Dental billing and coding are considered to be time-consuming processes susceptible to errors and mistakes, costing Dentists a lot of money. In order to improve this cash flow, the entire dental coding and billing process needs to be streamlined for efficiency. This is why we work on your dental management cycle billing to optimize your revenue and enable you to focus on the bottom line.

Fill Out The Form Below And Our Team Will Contact You Shortly

Our Dental Billing Services

We realize that your dental practice is continuously growing and evolving. To provide support, here are some of the top customized dental billing solutions for you.

Dental Billing Audit

A Dental Billing Audit can take your practice a long way forward if done right. Choose audit services to get a detailed analysis and strategies for revenue management.

Dental Credentialing

Dental Credentialing is as important as Dental Billing, and this is why our dental billing platform delivers peace of mind with credentialing through proper documentation.

Benefits Verification

The Breakdown of Benefits is probably the most important aspect of the entire billing process as it looks at insurance coverage and eligibility verification.

Dental Claim Submission

We believe in prompt dental claim submission for a smooth revenue cycle management that ensures profitability for independent dental practices.

Account Receivable

We aim to reduce your Account Receivables to negligible levels, increasing revenue collection and profitability in an adequate manner.

Payment Posting

Our payment posting mechanisms depict a clear financial picture of your dental practice with a conspicuous view of both insurance and patient payments

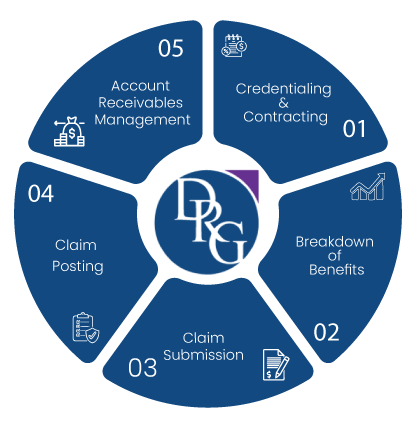

Revenue Cycle Process

It is said that the growth of a dental practice depends on the efficiency and effectiveness of the revenue cycle process. This is why our dental billing consultants focus on fulfilling all aspects of this revenue cycle to ensure optimum collections for both large-scale and small-scale dental practices.

Dental Benefits Breakdown

The first step in the revenue cycle process is the dental benefits breakdown that looks at insurance coverage and eligibility.

Dental Claim Billing

After the breakdown of benefits, we focus on proper dental billing to eliminate any chance of error.

Dental Claim Submission

Once the billing are checked and rechecked, we go for claim submissions to the insurance providers.

Follow Up and Appeals

Lastly, we strictly follow up on all claim submission and appeal against any denied claims that occur in the process

What Our Clients Say

Frequently Asked Questions

Dental Revenue Group is a leading Dental Billing Company operating across 50 states with 1000+ Dental billing experts working to assist Dental practices with their revenue collection. We have a 99% claim acceptance rate and we proudly claim to be a true professional billing company, proficient with American Dental Association coding mechanisms.

Dental Revenue Group works with the intent to make dental practices independent in their domain. For that purpose, we follow a Revenue Cycle Process that starts with benefits breakdown to submitting claim reimbursements. Moreover, our follow-up mechanisms are highly effective and we make sure that your Account Receivables are minimized.

Dental Revenue Group is a professional dental billing organization that helps in establishing a strong revenue cycle process for dental practices. Such a system is difficult to establish if you’re either billing for yourself or having an in-house billing setup that costs a lot and is difficult to sustain.

Although both of these billing domains are related to the revenue cycle management of practices; the major difference lies in the nature of coding for medical vs dental billing, along with a difference in the accreditation from different institutions. Moreover, dedicated billing companies such as I-Med Claims cater to medical billing while dental billing is handled by specialized dental billing companies such as Dental Revenue Group.

Dentists do bill CPT codes because medical plans do not pay for claimed payments for CDT treatments and therefore the CPT coding has to be used in a manner that describes the kind of treatment that was offered.

We’re Here to Help!

You can contact us anytime. Our Dental Billing Experts are available on business days for the assistance of our esteemed client practices. Let’s collaborate to make Dental billing easy and rewarding .